The City of Manhattan has had a very busy and productive year. I had the opportunity to attend the State of the City Address Power Lunch with Ron Fehr, Manhattan City Manager, on February 11, 2020. This meeting was well attended and very informative.

How many Manhattanites have been concerned with the conditions of the streets in Manhattan? I know I have been. My car could nearly fit into some of those potholes. The City of Manhattan has been making gains in their street improvements. North Manhattan Avenue and Kimball have seen some positive improvements. I live off of North Kimball, and the city has been working on this street improvement for quite some time. It is finally complete and moves traffic through so much more efficiently. The city has plans to complete 3 more projects on Kimball for this year. The city has received a KDOT grant to straighten the curve on Kimball between N. Manhattan Ave. and Denison. Also, be sure to check out the city plans for the North Campus Corridor project at the intersection of Kimball and College. This will include infrastructure, streetscape, landscaping, signage, pedestrian walkway, and bicycle lane improvements. Bill Snyder Family Stadium is located at this intersection, and this project will support K-State Athletics Master Plan as well as provide a gateway to the National Bio and Agro-Defense Facility (NBAF) located just East of this intersection at Kimball and Denison. The city website has a beautiful picture of what the proposed completed plan will look like. It will be a very nice attraction!

Speaking of NBAF, did you know that this past year there were 100 new hires? There are 100 new hires expected for this year also.

What are some other upcoming projects for this year? The city is continuing to research plans for Aggieville improvements. Improvements being considered are street designs, a 12th street pedestrian mall, and extra parking. Parks and Recreation will begin construction of 3 indoor recreation facilities. Cico Park baseball fields and trails will see improvements in a couple years as well. The Manhattan Conference Center is undergoing a $5,000,000, 14,000 sq. ft. expansion. This will help keep Manhattan a main conference center attraction for the state of Kansas.

The city has also initiated a city-wide flood levee improvement project for this next year. This will include an average 2-foot levee rise and makeover replacing the gates and other major components.

Does anyone fly MHK? Manhattan Regional Airport set a personal record with 77,533 passenger side enplanements in 2019! Did you know the main runway may be replaced in a couple of years and all efforts are planned to keep the runway at its current 150ft width. This is critical to meeting Ft. Riley’s needs as well as those of the KSU sports charters. The city continues to work on negotiations to accomplish this improvement.

These are just a few of the many ongoing projects and visions for the City of Manhattan. Check out the city website to learn more about Manhattan’s projects and plans.

I also would encourage you to attend a Power Lunch session through our local chamber of commerce. Why? Because Manhattan Matters. Links here to Ron Fehr’s presentation and podcast.

Until next time,

Barb Meitler, Foundation Realty

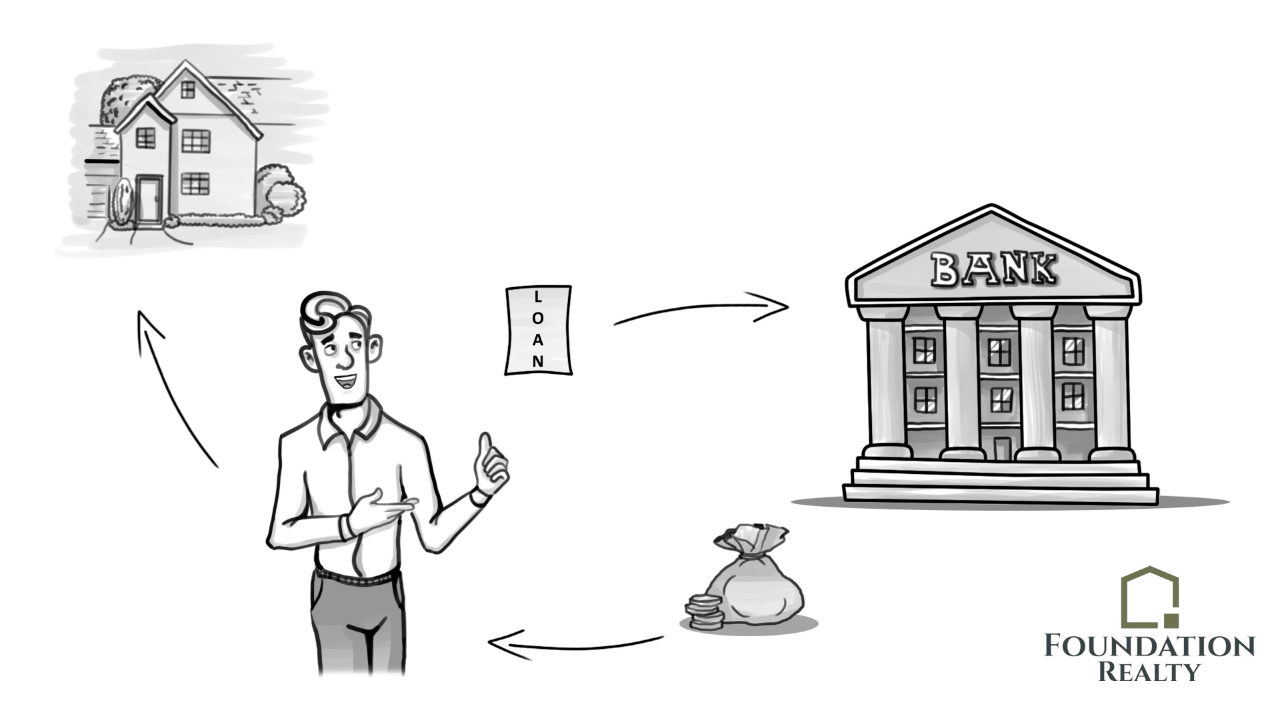

Did you miss our explainer video on lending? For this month’s video blog, we encourage you to revisit this excellent and short explainer video!

Join David as he interviews Todd Sheppard with Charlson and Wilson about the need for title insurance!

Join Morgan as he visits with Pottawatomie County Undersheriff Shane Jager about home safety!

Neighborhood news is Foundation Realty’s video blog. Join Randy as he interviews Jake Pugh about death and real estate!

Neighborhood news is Foundation Realty’s newest video blog. Tune in to hear Terry Robinson as he interviews Brad Claussen about code services in Manhattan KS!

Neighborhood news is Foundation Realty’s newest video blog. Tune in to hear Sarah Pfannenstiel, owner of Black Dog Properties, and David Renberg, broker of Foundation Realty discuss the local rental market, and what to expect in the area.

For my blog in March, I wanted to cover common ratios used to evaluate investment properties. After my last post, I had several questions, so I thought I would break these down.

First, it is worth covering the four benefits to owning real estate.

The first is the most obvious, cash. People pay you cash above and beyond your expenses (hopefully!) to live in the property you own.

The second is principal reduction. Many investors tend toward a more highly leveraged strategy. Say an investor has $100,000 to invest, they would prefer to invest in five $100,000 homes putting 20% down, rather than paying cash for one home. Because of this loan, the investor’s payment includes a principal payment and an interest payment. This paying down of principal is an expense in the cash benefit above, but is still a net positive benefit over the course of the year.

The third benefit is tax savings. Depreciation, loan interest, and operating expenses can all be written off on an investors taxes, creating a reduction in overall taxable income, and a tax savings.

Finally, real property appreciates. It grows in value, creating a net benefit.

Now that we understand the four benefits to owning real estate, now we can analyze a property’s return using ratios. Ratios help take properties that differ in nature or price, and give us an apples to apples comparison.

ROI (Return On Investment): This ratio measures the total return and compares it to the cash investment. It measures how much total benefit an investor receives in relation to how much cash they had to use to realize that benefit. You will notice, I do not include appreciation on one of my ratios. It is my belief that if you have to bank on appreciation to make an investment work, it is not a good investment.

Capitalization Rate: Cap rate is your net operating income (which would be profit if an investor had no mortgage) divided by the capital investment. It is basically a measure of how quickly an investment pays itself off, and simplifies the analysis by removing lending from the equation. For example, if someone found a lender that was willing to give a 100% loan based on other assets a investor had, then their cash-on-cash would be infinite, or thousands of percent. While other statistics can be skewed, the cap rate tends to give a clear and simple percentage that can be compared to any other cap rate accurately.

Cash-on-Cash: This is a ratio that many short term investors look at. This ratio measures how quickly will your cash replenish itself. It is straight forward, and can be useful in certain contexts.

I hope this information helps. If you would ever like to discuss investing in the area, please don’t hesitate to call us here at Foundation Realty!

Today’s highlight is brought to you by David Renberg, listing courtesy of Foundation Realty.

1014 Bluemont is an exceptionally close to campus investment property. It is a converted tri-plex with all modern plumbing and electrical, as well as modern mechanical units. All three units are on separate HVAC. There are three: two bed, one bath units. The top two units are rented together for $1,520 through next school year, and the basement has a history of renting for $610, and is currently up for re-lease at the end of this semester. The gross lease is $2,130 per month.

Pros:

Cons:

Bottom line:

This property is a great opportunity to acquire a property very close to both Aggieville and campus, at an attainable price point for the area.

See link to investment analysis here.

Call Foundation Realty at 785-473-7230 for more details about investing!

Understanding what happens with your loan is important in choosing the right lender. Click the play button below to watch our explainer video on what happens to your loan. It is important to know the types of loans so you can get the best one for you! Foundation Realty is proud to work with great local lenders.